Introduction & Contents

Why must my organization "register?"

The simple answer is “it’s the law.” Typically, states exercise regulatory authority over nonprofits based on one (or both) of two premises: the nonprofit is physically “present” in the state (e.g., has an office, owns real estate, or conducts program activities) or the nonprofit raises funds in the state.

In either case, a state may require the nonprofit to “register”, that is, to provide identifying information about the nonprofit and its operations. It is the latter premise for registration -- raising funds -- that provides the impetus for the Unified Registration Statement and the movement for standardized reporting in general. Organizations of any size and any means may find that raising funds from the public --even when conducted modestly from a single location -- will give rise to regulatory obligations to multiple states.

In fact, today most states regulate fundraising. They do so through statutes -- usually called “solicitation laws” -- that are primarily concerned with the solicitation of charitable contributions from the general public. The centerpiece of most of the regulatory schemes is comprehensive reporting, by nonprofits and by the outside fundraising firms and consultants they employ.

What is "registration?"

Compliance reporting under solicitation laws is divided into two pieces: (1) registration, which provides an initial base of data and information about an organization's finances and governance; and (2) annual financial reporting, which keeps the states apprised about the organization's operations with an emphasis on fundraising results and practices. Typically, states require both registration (at least an initial registration) and annual financial reporting.

With forty jurisdictions regulating in this manner, there is inevitably little consistency of approach. Some states have one-time registration; others require annual renewal of registration; some will require submission of every common governance and financial document; others make do with just an IRS Form 990; and so forth. But each has its own registration form (or forms) and, until the advent of the URS, required its submission, verbatim.

PLEASE TAKE SPECIAL NOTE: The URS and this packet are designed for registration only. For many states, the URS cannot be used to fulfill annual financial reporting requirements. A project is underway to produce a standardized format -- like the URS -- for annual financial reporting (see below). For now, the URS is the sole device for standardized, multi-state filing and it applies only to registration and registration renewal (which may be required yearly but, we say again, may be distinct from annual financial reporting).

Which nonprofits must register (and when)?

Generally, any nonprofit conducting a charitable solicitation within the borders of a state, by any means, is subject to that state’s law and is therefore required to register (and must do so before soliciting). Also, generally, the operative terms “charitable” and “solicitation” are defined very broadly and could include, for example, a website posting by an environmental organization inviting contributions from the public.

In other words, the soliciting organization need not be a “charity” in a strict sense nor have any physical presence of any kind in the state. So, a letter, phone call, or newspaper ad requesting financial support from a state's residents is enough, in the unchallenged legal opinion of the states, to trigger the coverage of (i.e., give jurisdiction to) that state's solicitation law.

However, Internet fundraising does not neatly conform to existing models -- neither jurisdictional models nor fundraising models. The ultimate jurisdictional question, roughly put, is “Has someone purposefully directed a charitable solicitation to a resident of our state?” A “yes” provides a state with a rationale for exercising jurisdiction. The question and answer get very fuzzy in cyberspace.

The National Association of State Charity Officials (NASCO), recognizing the challenges posed for both nonprofits and regulators, has developed a protocol to aid all concerned (see the “Charleston Principles” at www.nasconet.org). The protocol will guide state officials in exercising jurisdiction over Internet transactions and it will help nonprofits determine whether (and when) their Internet fundraising activity will subject them to solicitation law registration and reporting.

Against this framework of all-inclusiveness is a patchwork of exclusions from coverage. These are the product of each state's constitutional and political considerations. Either through exemption from registration requirements or out-and-out exclusion from the law, each state excuses some nonprofits from registering. For example, every state grants an exemption (or exclusion) to “religious organizations,” as the term is respectively defined, and most have exemptions for colleges and universities or for organizations raising only small amounts (say, under $5,000). Please see the Appendix for details on each state.

Significantly, technical compliance with any state's registration law requires initial registration before the first solicitation has been directed into the state. The fact remains that many nonprofits have not done the necessary legal homework before launching fundraising campaigns. If your nonprofit is one of these, you should be very concerned. But you should not be deterred from going ahead with registration because you fear you are breaking a law already and it's too late to comply.

Failure to register before soliciting is a violation of law and could subject the organization (and in some circumstances, its officers or directors) to whatever sanctions (e.g., a substantial fine) exist in each state's law. But, the states generally wish to encourage honest efforts to comply with registration laws and tend to employ sanctions only when enforcement officials deem it necessary. So, an organization able to demonstrate its good faith which promptly registers after discovering its obligation (albeit tardily) stands a good chance of avoiding or minimizing sanctions. The bottom line: registration is the law and you must comply as soon as possible.

What is the Unified Registration Statement?

The URS represents but a single part of an effort to consolidate the information and data requirements of all states requiring registration. Organized by the National Association of State Charities Officials and the National Association of Attorneys General, the project’s aim is to standardize, simplify, and economize compliance under the states' solicitation laws.

The URS effort consists of three phases: (1) compiling an inventory of registration information demands from all states, (2) producing a format (or form) which incorporates all (or most) of these demands, and (3) encouraging the states to accept this “standardized” format as an alternative to their own forms. The effort is dynamic and ongoing, now represented by version 4.02 of the URS, which is accepted by thirty-seven of the forty jurisdictions requiring registration. Reflecting this dynamic, the URS will be updated continually by way of its website (http://www.multistatefiling.org/). See Item #6 in the “Reminders” section (URS Instructions, pg. 4) for more information on URS packet updates.

How do you use the URS?

The URS is an alternative to filing all of the respective registration forms produced by each of the cooperating states. In those states, a registering nonprofit may use either the state form or the URS. Thus, the URS proves most useful to nonprofits soliciting regionally or nationally and, therefore, subject to the registration laws of multiple states. But the URS may be used by any nonprofit that is registering in a state accepting it.

Conceptually, the process is simple. You fill out the URS by following its accompanying instructions; photocopy the completed URS (with state-specific items, including signature lines, left blank); fill in any state-specific items; execute (i.e., sign with or without notary) according to each state's requirements; collect and attach the specified governance (for initial filings) and other documents; write a check for the prescribed registration fee (if any); and mail the package, covered by the URS, to the respective state's administering agency. Please see the Appendix for a listing of state-specific items, necessary documents, fee for filing, and address of each state’s administering agency. Important note: do NOT send completed URS forms to the Multi-state Filer Project; we do not process these. They must go to each state in which you are registering.

What's in this packet?

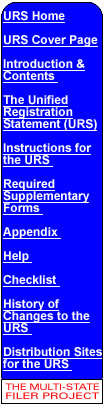

The URS is presented here along with additional materials and information. The goal is to enable most users to complete their registrations (for URS states) without the need to acquire information or materials outside this packet. Please read the following description of the packet's contents to learn what's here and where to find it:

* URS (3 pgs) and Instructions (4 pgs) – Only one copy of the URS is provided with this packet. Make a back up photocopy of the blank form before you begin work. Note that the submitted URS will be considerably longer than the 3 pages of the form due to several required attachments. Please consult the instructions while filing out the URS for information on how to answer each question.

* Supplementary Forms (22 forms/instructions from 15 jurisdictions) – A number of states wished to cooperate with the URS effort but found it necessary for legal or other reasons to request information and/or offer instruction on forms designed to supplement the URS. For those states, the respective supplementary form or information must accompany the URS.

* Appendix (15 pgs) – Provides state-by-state filing details for each of the thirty-six cooperating states and DC. Please closely attend to the following notes for helpful information about the Appendix:

(1) The Exemptions entries are NOT verbatim from the laws. If you believe your organization may be exempt in one or more states, be cautious and refer to the law (See Governing law in the Appendix for citation), regulations, and/or applicable form from the respective states.

(2) Due date refers to the day that the first filing subsequent to the initial registration is due (initial registration is required before solicitation begins). This subsequent filing may be termed a “registration renewal” or an “annual financial report.” See (7), below, for information on due dates for annual financial reports.

(3) Fund Raiser contracts refer to the actual contractual documents establishing your relationship with outside fundraising professionals described in URS Item 20. A “yes” here in a state's entry means you must copy and submit all such contracts, along with the URS, to that state. Note too that subsequent contracts may have to be submitted (either when entered into, with registration renewal, or as part of required annual financial reporting).

(4) Your Certificate of Incorporation, Bylaws, and IRS Determination Letter (official letter from Internal Revenue Service establishing federal tax-exempt status) are one-time submissions with initial registration. Unless amended after initial registration, they need not accompany renewal filings.

(5) In obvious contrast, Audit and IRS Form 990 change from year to year. A “yes” means that the most recently completed versions must be submitted with the URS. Note that while a state (e.g., Oregon) may not require either for purposes of registration, it might require the current version of either or both as part of annual financial reporting. Also note that states articulate the need to submit an audit very differently – pay close attention to the requirements listed in the Appendix to the URS, as the actual terminology of each state is used for this entry.

(6) Information about registration for States not yet accepting the URS is included.

(7) Basic information on annual financial reporting (and/or registration renewal) for all URS states is included in a separate section. Although the URS has not been officially sanctioned for use in fulfilling annual financial reporting/renewal requirements, the information is provided here to help filers understand and coordinate their reporting obligations.

* Help (3 pgs.) – Provides several aids for filers, itemized below:

(1) The Checklist recapitulates much of the Appendix in an easy-to-read, yes-no format. It serves as a useful tool when, for example, you are submitting multiple registrations and need to be assured that each state receives the necessary components.

(2) Changes to the URS detail changes to each version of the URS packet since v. 2.00.

(3) Site List provides sources for printed copies of the URS packet.

What's next for the Standardized Reporting Project?

In every sense, both the URS and the Project are a work in progress. There are four components to reporting under the solicitation laws: registration for nonprofits, annual reporting for nonprofits, registration for outside professionals, and annual reporting for outside professionals. Although work on the additional four components is under way, the URS (nonprofit registration) is the sole product in service.

While the “standardized” approach implies continual change, even the threshold work on the URS is not complete. For example, page 12 of the Appendix lists the three remaining states that, for one reason or another, have not yet chosen to participate by accepting the URS. Neither the URS nor any subsequent products will achieve maximum utility until all states are cooperating.

Version 4.02 of the URS packet contains numerous refinements, many of them the product of user comments. Consequently, your feedback is very important. Please direct any comments you may have about suggested improvements (or about errors you believe you've discovered) to the URS, its instructions, or to the accompanying materials to:

Karin K. Goldman

Charities Trusts Bureau

New York State

Attorney General Office

120 Broadway

Third floor

New York, NY 10271-0002

(212) 416-8060

chnkkg@oag.state.ny.usand/or Robert Tigner

General Counsel

Multi-State Filer Project

1612 K Street, NW

Suite 510

Washington, DC 20006-2802

(202) 463-7980

Note: Please do not send the Multi-State Filer Project your completed URS form.

These go directly to the state(s) you are registering in.

© 2014 MULTI-STATE FILER PROJECT