This document is not for printing. Please print and submit the PDF version of the URS instead.

|

STATE OF TENNESSEE DEPARTMENT OF SECRETARY OF STATECHARITABLE ORGANIZATION REGISTRATION INSTRUCTIONS AND SUPPLEMENTAL REGISTRATION FORM Read instructions carefully.� Complete all questions and provide all requested information.��� A copy of the �Summary of Financial Activities (SFA) Form and the organization�s filed IRS Form 990 (and any other forms required to be filed with the IRS) must be submitted with the registration application.� Organizations with gross revenue in excess of� $250,000 must also submit an audit report. Registrations expire each year on the organization�s anniversary date.� The last day of the sixth month following the month in which the fiscal year ends is the organization�s anniversary date.� Applications received after the expiration of the current registration period shall be assessed a late fee of twenty-five dollars ($25.00) for each month, or portion thereof, that the report is late filed.� Registration applications will not be approved until late fee assessments are paid. INSTRUCTIONS 1.� Complete the Unified Registration Statement (URS). 2.� Submit the required filing fee. 3.�������� In addition to the information supplied in the URS, you must provide the � following information: A.������� Title and birth date of each officer, director, and executive of the organization.� Attach a ten year employment history, beginning with their most recent employment. B.������� Is your organization currently authorized by any Tennessee authority to solicit contributions?���� Yes __���� No __��� FOR OFFICE USE ONLY Date Received: State Registration No. ������������������������������� �� Fee Payment Received $�������������������������� Receipt No. ������������������������������������������������

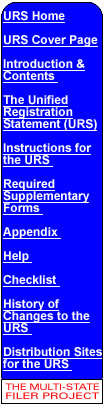

© 2014 MULTI-STATE FILER PROJECT |